Master your money, gain freedom, and set the stage for lasting wealth.

Why Tracking Your Spending Is the First Step to Financial Freedom?

Your 20s are a time of exploration, new experiences, and financial independence. But with newfound freedom comes the risk of overspending and missing out on building wealth early. The key to financial success starts with knowing exactly where your money goes. Tracking your spending is the foundation of any smart financial plan. It helps you:

- Understand your habits

- Identify unnecessary expenses

- Free up cash for saving and investing

Without this knowledge, budgeting is guesswork. But with it, you gain control and confidence.

Pro tip: Start tracking before you create a budget. This way, your budget reflects your real lifestyle, not just ideal assumptions.

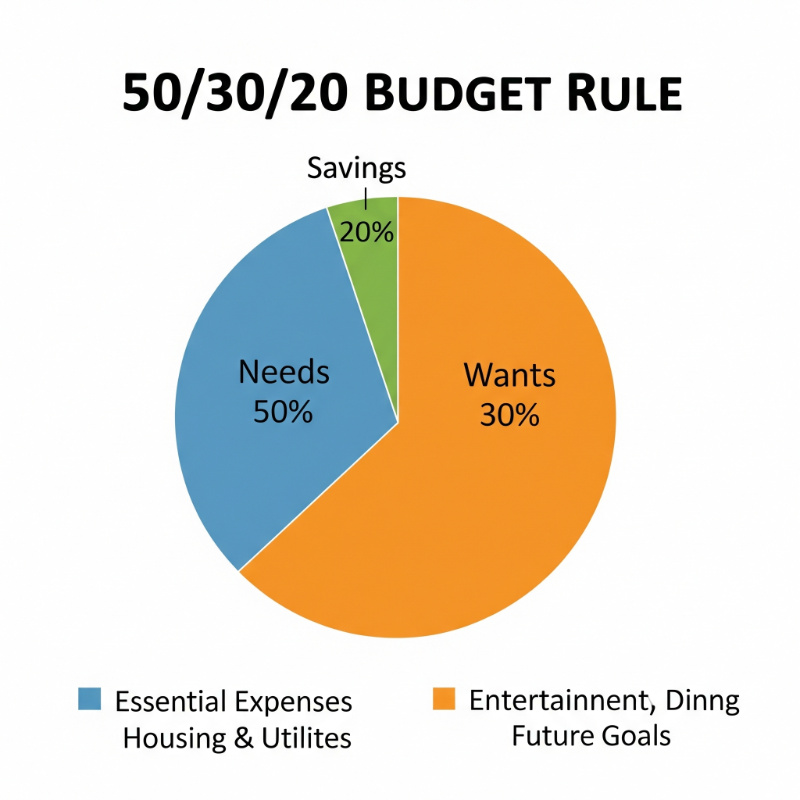

The 50/30/20 Rule: A Simple Framework to Budget Smarter

Budgeting can feel overwhelming, but it doesn’t have to be complicated. The 50/30/20 rule is a straightforward way to allocate your income:

This rule balances discipline with flexibility, ensuring you cover essentials, enjoy life, and build financial security.

Best Budgeting Apps for Tracking Spending Worldwide (2025)

In 2025, budgeting apps are smarter, more secure, and available almost everywhere. Whether you’re in the US, Europe, Asia, or beyond, these top-rated tools can help you track spending, set budgets, and manage your money with ease.

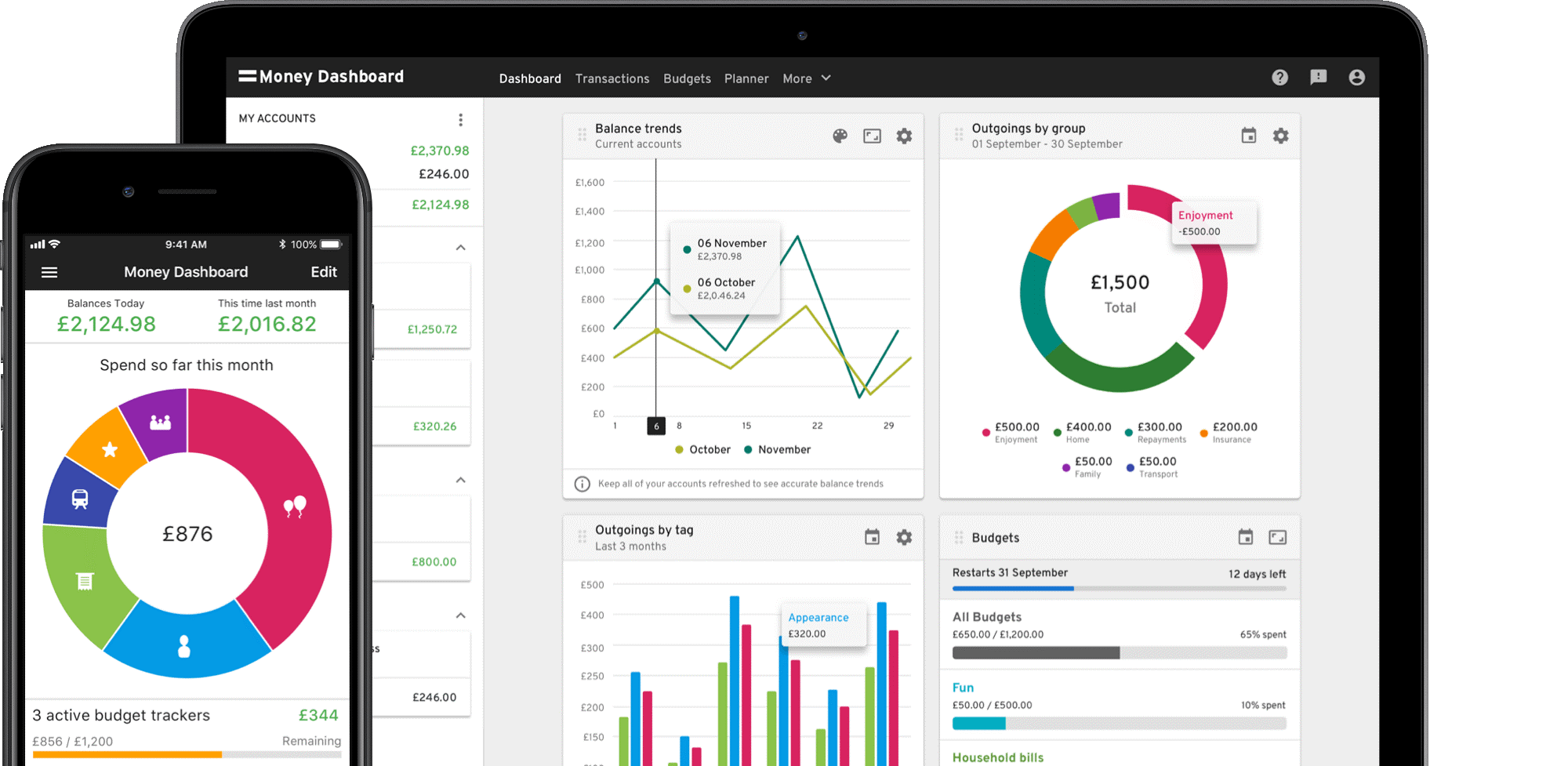

- Money Dashboard:

Connects all your bank accounts to give a complete spending overview.

- Emma:

Tracks subscriptions, categorizes spending, and offers personalized insights.

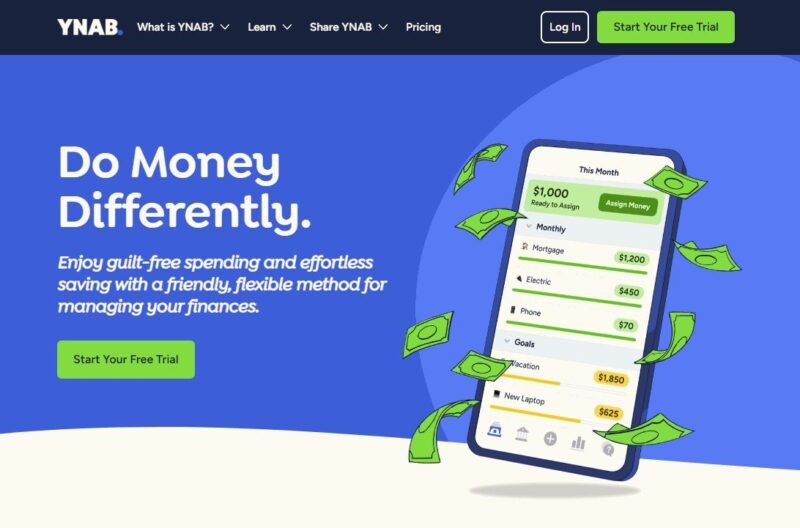

- YNAB (You Need A Budget):

- Focuses on zero-based budgeting, giving every pound a purpose.

These apps automate tracking, send alerts for overspending, and help you stay accountable.

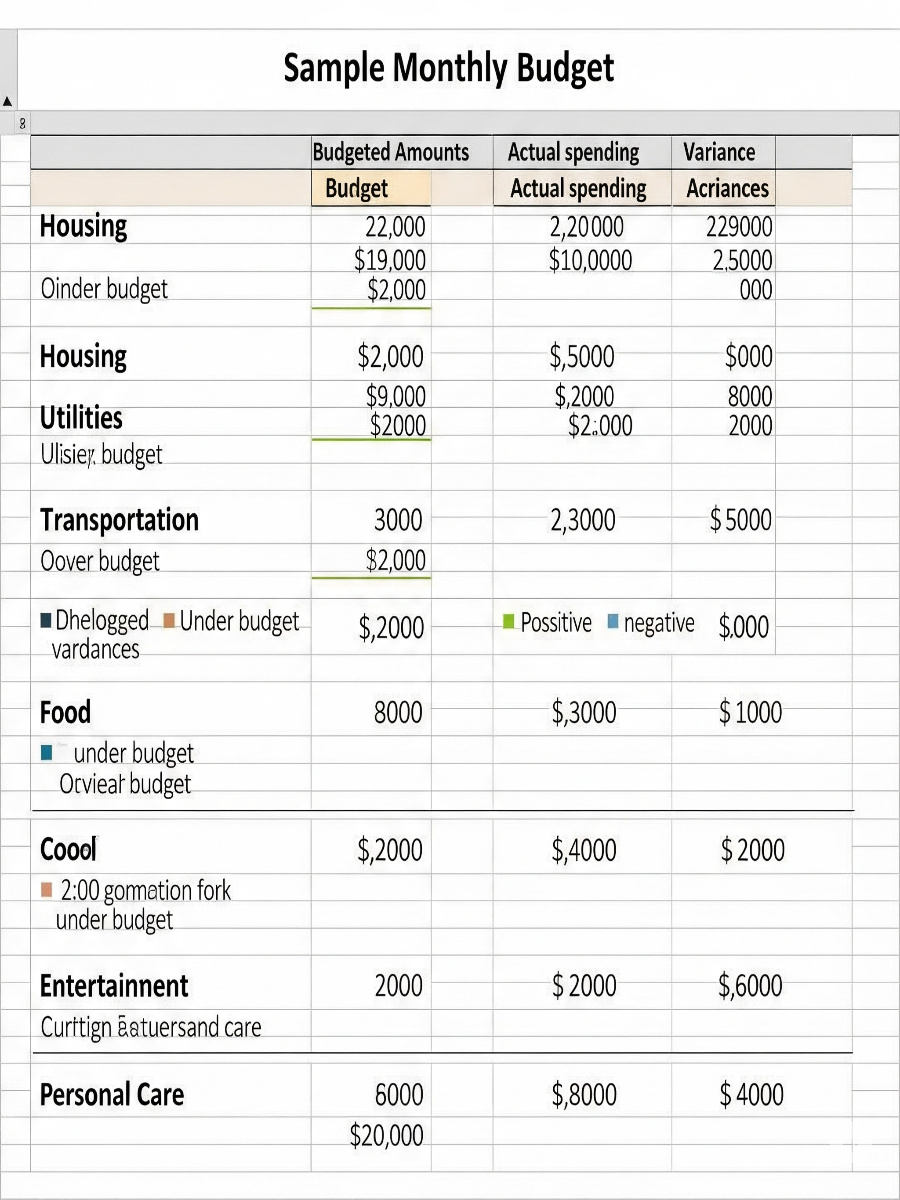

Step-by-Step Guide to Building Your Budget

Creating a budget that works for you takes a few simple steps:

1. Gather Your Financial Data

Collect your bank statements, bills, and receipts from the last 2–3 months. This gives a clear picture of your actual spending.

2. Categorize Your Expenses

Use your chosen app or a spreadsheet to sort expenses into Needs, Wants, and Savings/Debt.

3. Set Realistic Limits

Based on your income, allocate money according to the 50/30/20 rule—or adjust to fit your lifestyle.

4. Automate Savings

Set up direct debits to transfer money into savings or investment accounts right after payday. This “pay yourself first” approach prevents overspending.

5. Review Weekly

Check your spending weekly to catch overspending early and adjust your budget as needed.

Why Weekly Reviews Make a Difference

Weekly budget reviews help you:

- Stay mindful of spending habits

- Celebrate small wins and progress

- Adjust your budget to life changes (new job, rent increase, etc.)

- Avoid end-of-month financial surprises

Regular reviews keep you motivated and accountable, turning budgeting into a habit, not a hassle.

Avoid Common Budgeting Mistakes

Even the best budgets fail without awareness of common pitfalls:

- Being Overly Restrictive: A budget should be sustainable and allow for enjoyment.

- Ignoring Irregular Expenses: Don’t forget annual costs like insurance, holidays, or subscriptions.

- Not Adjusting Your Budget: Life changes—update your budget regularly.

- Neglecting Savings: Always prioritize paying yourself first.

Real-Life Example: How Budgeting Changed My Life

“Before I started tracking my spending, I had no idea how much I was wasting on takeaways and subscriptions. Using Money Dashboard, I cut my ‘wants’ by 15%, saved an extra £150/month, and started investing. Now, I feel in control and excited about my financial future.”

— Sarah, 27, London

How Tracking Spending Leads to Wealth Building

Tracking spending is not just about cutting costs; it’s about making informed decisions that free up money to build wealth. When you know your spending patterns, you can:

- Identify money leaks (unused subscriptions, impulse buys)

- Redirect funds to emergency savings and investments

- Avoid lifestyle inflation as your income grows

Remember, wealth isn’t just about how much you earn—it’s about how much you keep and grow.

Bonus Tips for Budgeting Success in Your 20s

- Set SMART Financial Goals: Specific, Measurable, Achievable, Relevant, Time-bound goals keep your budgeting purposeful.

- Use Multiple Savings Pots: Apps like Monzo let you create “pots” for different goals (holiday, emergency fund, investments).

- Reward Yourself: Budget for small treats to stay motivated.

- Educate Yourself: Follow personal finance blogs, podcasts, and YouTube channels to stay inspired and informed.

Final Thoughts: Start Small, Stay Consistent, and Watch Your Wealth Grow

Tracking your spending and budgeting isn’t about restriction—it’s about empowerment. By understanding where your money goes, you can make smarter choices, reduce financial stress, and build a solid foundation for wealth in your 20s and beyond.

1 thought on “How to Track Your Spending & Build a Realistic Budget in Your 20s (2025 Guide)?”