📘 Introduction: Why the Federal Reserve Matters in 2025

In 2025, the Federal Reserve continues to be one of the most powerful forces in the global financial system. From controlling interest rates to fighting inflation, the Fed directly affects your personal finances—whether you’re a student, homeowner, investor, or small business owner. With markets more sensitive than ever to economic signals, understanding how the Federal Reserve operates can help you make smarter financial decisions in your daily life.

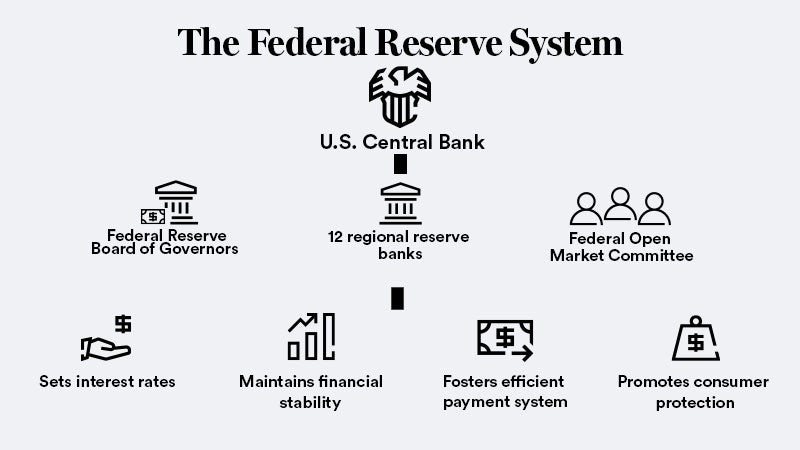

💹 What Is the Federal Reserve?

The Federal Reserve, often called the Fed, is the central bank of the United States. Established in 1913, its main responsibilities include regulating the money supply, managing inflation, stabilizing prices, ensuring maximum employment, and supervising financial institutions. In 2025, the Fed’s influence goes far beyond the U.S., playing a pivotal role in shaping global markets and investor confidence.

📊 How the Federal Reserve Controls Interest Rates in 2025

One of the Fed’s most effective tools is the federal funds rate, the interest rate at which banks lend money to one another overnight. When inflation rises, the Federal Reserve raises interest rates to cool spending. Conversely, when economic growth slows, it lowers rates to encourage borrowing and investment.

In 2025, the Fed has kept rates relatively high to combat post-pandemic inflation, impacting everything from mortgage rates to credit card APRs. As of mid-2025, the federal funds rate hovers between 5.25% and 5.50%, according to official Fed data.

🧮 Inflation and the Federal Reserve’s Battle to Control It

The Federal Reserve’s primary goal in 2025 remains controlling inflation. After the 2022–2023 global inflation spike, the Fed introduced a series of aggressive rate hikes to stabilize prices. While inflation has cooled to around 3.1% in 2025, it’s still above the Fed’s 2% target.

This policy tightening affects every day Americans and global consumers alike, leading to:

- Higher loan payments

- Increased cost of living

- Stronger U.S. dollar

🌎 Global Ripple Effects of Federal Reserve Policy

The Federal Reserve’s decisions don’t just stay within U.S. borders. Because the dollar is the world’s reserve currency, any interest rate changes create ripple effects across international markets. In 2025, developing countries like Nigeria, Bangladesh, and the Philippines face higher borrowing costs and weaker currencies due to the stronger U.S. dollar.

Additionally, U.S. rate hikes reduce capital inflow to emerging economies, making it harder for foreign governments to finance infrastructure and development projects.

💰 Federal Reserve’s Impact on Individuals and Businesses

Whether you realize it or not, the Federal Reserve plays a role in your day-to-day life:

- Homebuyers face higher mortgage rates due to Fed policies.

- Students may pay more on federal and private student loans.

- Small businesses experience costlier financing options.

- Investors adjust their portfolios based on interest rate changes.

If you’re looking to make informed financial decisions, check out our latest guide: Daily Money Habits to Improve Your Financial Life in 2025

🧠 What Experts Say About the Federal Reserve in 2025

According to Jerome Powell, the current Chair of the Federal Reserve, “We are committed to achieving our dual mandate of stable prices and maximum employment.”

Top financial analysts from Goldman Sachs, J.P. Morgan, and Bloomberg agree that the Fed is likely to keep interest rates steady for the rest of 2025, with possible rate cuts in early 2026 if inflation continues to decline.

🧭 What’s Next for the Federal Reserve?

Going forward, the Federal Reserve’s 2025 agenda include:

- Monitoring inflation trends

- Adjusting interest rates cautiously

- Preparing for possible economic slowdown

- Ensuring financial stability through regulatory reforms

Stay ahead of the curve by subscribing to our finance updates: Federal Reserve News Hub.

✅ Final Thoughts

Understanding the Federal Reserve in 2025 is not just for economists. From loan approvals to global currency fluctuations, the Fed’s influence is felt by everyone. Whether you’re budgeting for your family, managing a business, or planning an investment strategy, staying informed about the Fed can help you navigate financial uncertainty with confidence.